Prevent and remediate your compliance problems. Fast!

Credit Unions | Banks | DORs | MRBAs | Findings | Violations

Get your Q2 2025 Report

From DOR to Done

Got a DOR, MRBA, or Findings?

We help banks and credit unions resolve regulatory issues - fast.

- DORs and MRBAs from NCUA, FDIC, or OCC

- CAMELS 3–5 risk areas (ROA, capital, delinquency)

- Fair Lending and HMDA violations

- Governance gaps and weak succession plans

- Reg B, Reg E, and BSA/AML compliance issues

- Repeat or unresolved exam findings

- AI-powered root cause analysis

- Board-ready remediation plans in days

- Rewritten policies and documentation

- Guidance through execution and examiner follow-up

Don’t wait for escalation.

Show regulators and your board that you’re already fixing the problem - with Kintera.

One View. Complete Control.

For the Executive Team

- Compare key metrics against peer averages and market trends

- Identify opportunities for growth and risk management

- Fast, dynamic, and cost-effective - empower your team to act with confidence

For Board Members

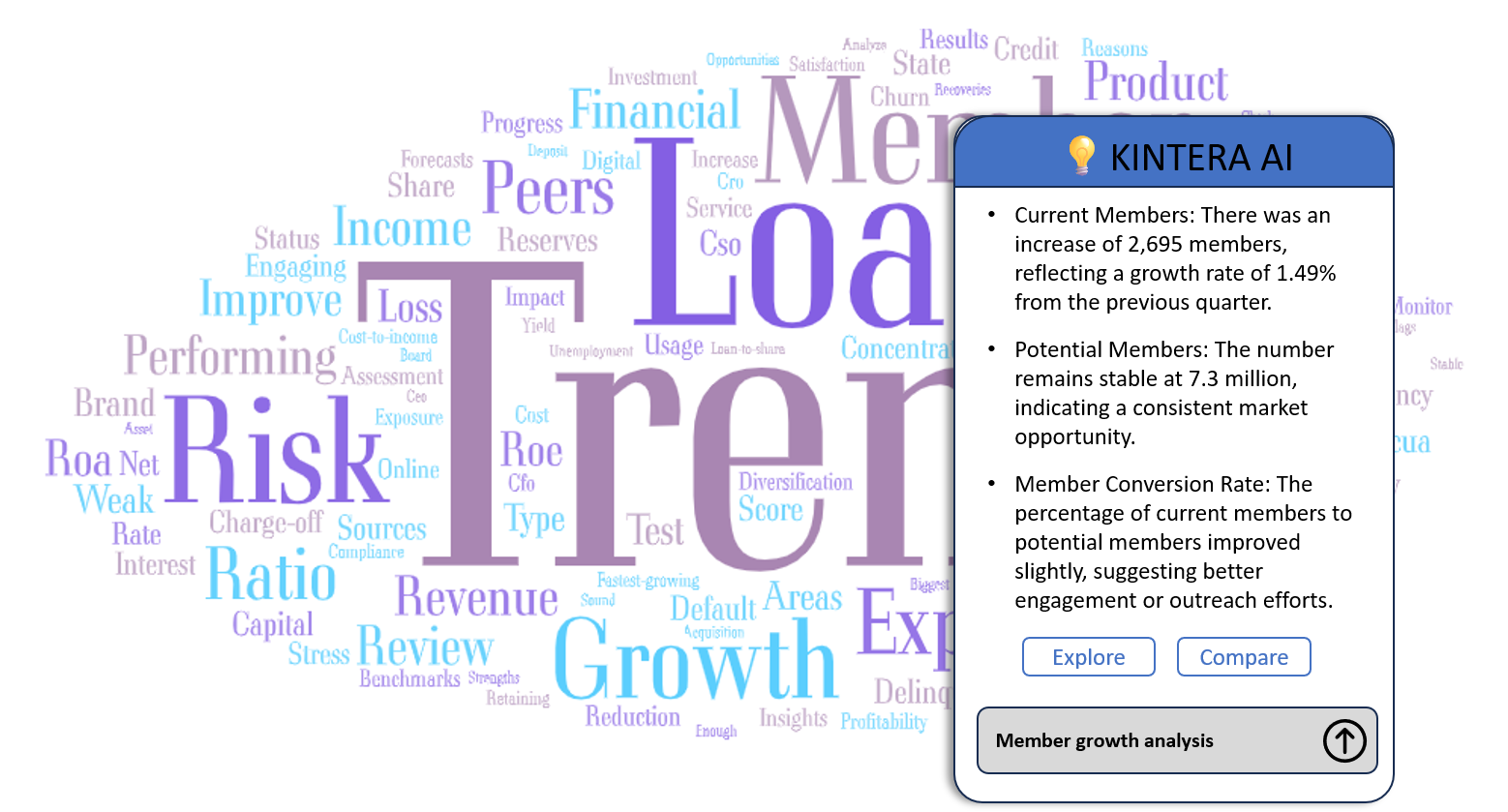

- Get clear, AI-generated summaries of financial reports

- Ask questions & get instant answers on your positioning

- Navigate regulatory & market challenges with confidence

- No private data collected. Just insights that matter.

How it works?

Our Plans

Pick the right plan for your business

Insights

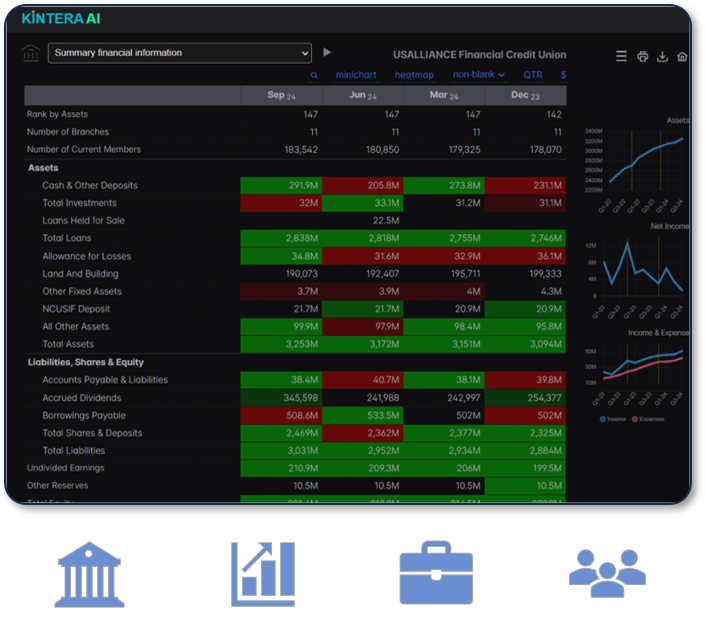

Real-time performance dashboards and market benchmarking that pinpoint financial trends and competitive position.

Financial Performance Dashboards

Peer Benchmarking & Ranking

Market & Competitive Analysis

Drill-down Statistical Analysis

Root Cause Analysis

Industry News & Announcements Feed

💡AI Insights Assistant

Compliance

Automated risk assessments and workflow tools that surface and mitigate regulatory exposure before examiners do.

Fair Lending (HMDA) Assessment

DOR & CAMEL Scoring Resolution

SAR Workflow Automation

Marketing Compliance

Real-time Regulatory Adherence

Loan Risk & HMDA Analysis

💡AI Compliance Assistant

Core360

Customer-profitability analytics and auto-generated board materials that fuel data-driven strategic decisions.

Customer Profitability Analytics

Automated Board Package Builder

Meeting Minutes & Summary Generator

Collaborative Agenda & Task Tracking

Strategic SWOT Snapshot

Executive Pipeline & M&A Analytics

💡AI Governance Assistant

| Insights | Compliance | Core360 | |

|---|---|---|---|

| Service & Support | |||

| 24x7 Support | ✔️ | ✔️ | ✔️ |

| Customer Success Manager | Digital | Manager | Digital |

| Launch Success Program | Digital | Manager | Manager |

| Training | |||

| Online Training Library | ✔️ | ✔️ | |

| Community Group Training Webinar | ✔️ | ✔️ | |

| Private Group Training Webinar | ✔️ | ✔️ | |

| 1 on 1 Training for Directors & Executives | Add-on | Add-on | |

| Professional Services | |||

| Advisory & Implementation Services | Add-on | Add-on | |

| Custom Analytics & Integrations | Add-on | Add-on | |

About Us

Located in the heart of Cambridge, MA, Kintera is an AI-driven platform dedicated to transforming how Credit Unions and Banks operate. Our mission is to empower executives, board members, and teams with the tools they need to streamline governance, foster growth, and succeed with confidence. We leverage the power of AI to simplify complex processes, remove routine tasks, and deliver actionable insights that drive impactful decisions. Committed to ethical practices, we prioritize transparency and integrity in every solution we offer.

Mission Statement

To harness the potential of AI to empower financial institutions, enabling them to focus on what truly matters-serving their members, achieving sustainable growth, and navigating the future with confidence and clarity.What Kintera Means

AI often operates through a proto-language, breaking down concepts into fundamental meanings:Our name reflects our commitment to providing financial institutions with the knowledge and tools they need to navigate the future with confidence.